do you pay taxes when you sell a car in illinois

It starts at 390 for. When you sell a car for more than it is worth you do have to pay taxes.

How To Sell A Car Without A Title Kelley Blue Book

The amount that you have to pay for your Illinois used car sales tax or your Illinois new car sales tax depends on what city you live in.

. Even in the unlikely event that you sell your private car for more than you paid for it special HM Revenue and Customs rules mean that you dont pay Capital Gains Tax. Sales taxes in Illinois are calculated before rebates are applied so the buyer who pays 9500 after a 2500 rebate will still pay sales tax on the full 12000. But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit.

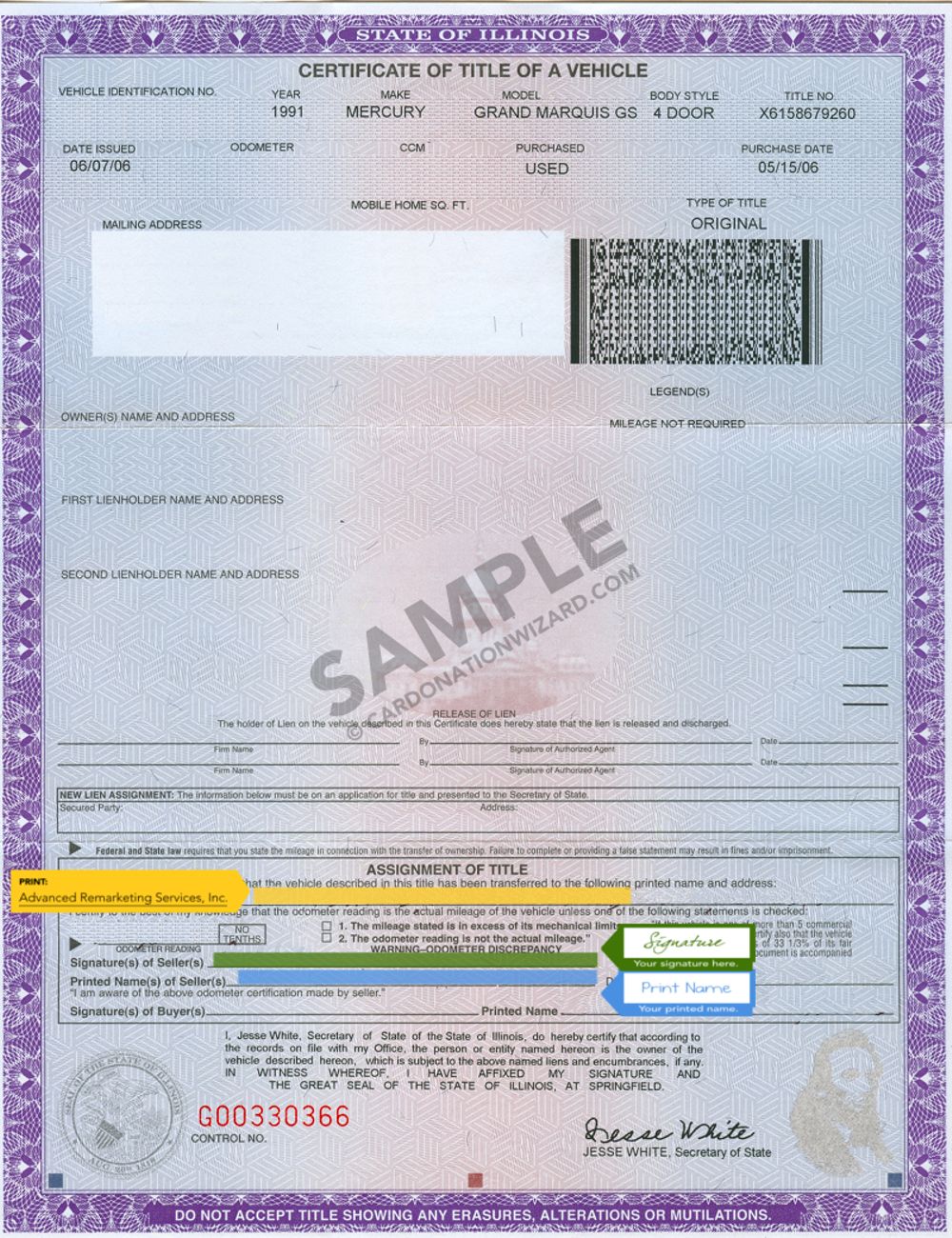

In addition to completing the application form you will also need to pay the transfer fee of 25. If you must do so you should attach a letter from the leasing company or a copy of the lease agreement to Form RUT. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

Oak Brook Sales Tax. DMV or State Fees. Cost of Buying a Car in Illinois Increased in 2020.

If you sell a used car for less than its original purchase price plus any long-term improvements the buyer may have to pay sales tax on the purchase but you wont incur a tax obligation. So if you bought the car for 14000 and sold it for 8000 you would have a capitol loss of 6000. However you do not pay that tax to the car dealer or.

However you the lessee may be required to assume this responsibility. You do not need to pay sales tax when you are selling the vehicle. Regardless of whether you sell to a dealer or private party.

However you wont need to pay the tax immediately you will need to submit the amount as capital gains during tax season. The amount of capital gains tax you will have to pay may vary depending on numerous variables especially how much income you have from other. The minimum is 725.

They buyer pays the sales tax. Some owners will apply for a refund of any remaining Vehicle Excise Duty car tax on the vehicle though this is usually factored into. Multiply the vehicle price before trade-in or incentives by the sales tax fee.

Vehicle sales tax for vehicles sold by a dealer Usually 625 but can vary by location. Whether you have to pay taxes on the sale of your car mainly depends on how much you sell it for. Thus you have to pay capital gains tax on this transaction.

You do not have to pay this tax until you file your tax return for the year. The party who buys the car from you pays the sales tax. As the owner of the vehicle the lessor generally is liable for Illinois Use Tax and responsible for filing and paying this tax using Form RUT-25-LSE when the vehicle is brought into Illinois.

Vehicle use tax for vehicles purchased from another individual or private. If your car is a collectible and has appreciated in value you are subject to capital gains tax on the profit. If you sell a vehicle to a customer who will title it in one of those states then you must charge the customer Illinois sales tax at the foreign states tax rate or at 625 whichever is less.

You can also pick up a form at the Illinois SOS office or request one to be sent to you by calling 800 252-8980. This tax is paid directly to the Illinois Department of Revenue. For vehicles worth less than 15000 the tax is based on the age of the vehicle.

You would not have to report this to the IRS. However if you bought it for 14000 and sold it for 15000 earning a 1000 capital gain you would report this on your tax return using Schedule D on Form 1040 thats appropriately titled Capital Gains and Losses. Buyers must pay a transfer tax when they buy a car from a private seller in Illinois although this tax is lower when you buy from a private party than when you buy from a Dealer.

Use the Illinois Tax Rate Finder to find your tax. It starts at 390 for a one-year old vehicle. You dont have to pay any taxes when you sell a private car.

Income Tax Liability When Selling Your Used Car. Selling a car for more than you have invested in it is considered a capital gain. If you are transferring your license plates and titling the car at the same time there is an additional 155 fee.

Do I Have to Pay Tax When I Buy My Car. And since Carmax is a dealer they dont pay the taxes when they buy the car from you. Youll need to have the title sales tax form and other paperwork which varies according to the situation.

The trade off to eliminate the tax cap was to slightly increase the tax on private car sales. To calculate the sales tax on your vehicle find the total sales tax fee for the city. For example if you purchased a used car from a family member for 1000 and later sold it for 4000 you will need to pay taxes on the profit.

The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. For example imagine you are purchasing a vehicle for 20000 with the state sales tax of 725. Sometimes even if you sell the car for a little more than its actual value you dont have to pay tax for it.

Who Pays Sales Tax When Selling a Car Privately in Illinois. Depending on the value and your tax bracket if you have owned the car for more than a year youll need to.

Volkswagen Ad Fad Vintage Volkswagen Volkswagen Beetle Vw Volkswagen

How Do I Sell My Car Illinois Legal Aid Online

Illinois Car Sales Tax Countryside Autobarn Volkswagen

7 Benefits To Trading In Your Car Over Selling It Yourself Legend Auto Sales Blog

Nj Car Sales Tax Everything You Need To Know

What Is Illinois Car Sales Tax

When I Sell A Car Do I Give Them The Registration Sell My Car In Chicago

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

When I Sell A Car Do I Give Them The Registration Sell My Car In Chicago

What S The Car Sales Tax In Each State Find The Best Car Price

A Complete Guide On Car Sales Tax By State Shift

Selling A Car Out Of State Here S What You Need To Know

Does The Seller Have To Pay Tax On A Vehicle When He Sells It

Trade In Car Or Sell It Privately The Math Might Surprise You

Auto Lifestyle Salvage Cars Car Dealer Vehicles

What Is The Safest Form Of Payment When Selling A Car Sell My Car In Chicago

/GettyImages-160143914-490a0fd99380456fb809d575104c4719.jpg)